This shifting reduces corporate income tax revenue by nearly $200 billion, or 10% of global corporate tax receipts.

About the research

Researchers from the University of California, Berkeley and the University of Copenhagen have produced a database showing where corporations book their profits globally. Exploiting these data, the authors develop a methodology to estimate the amount of profits shifted to tax havens by multinational companies and how much each country loses in profit and tax revenue from such shifting. Globally, multinational firms shifted more than $650 billion in profits to tax havens in 2016 and this shifting reduced global corporate tax receipts by close to 10%.

Multinational firms shift profits to tax havens to reduce their global tax bills. Take the example of Google: In 2017, Google Alphabet reported $23 billion in revenue in Bermuda, a small island in the Atlantic where the corporate income tax rate is zero. Globally, about $650 billion in profits are shifted to such tax havens by multinational from all countries.

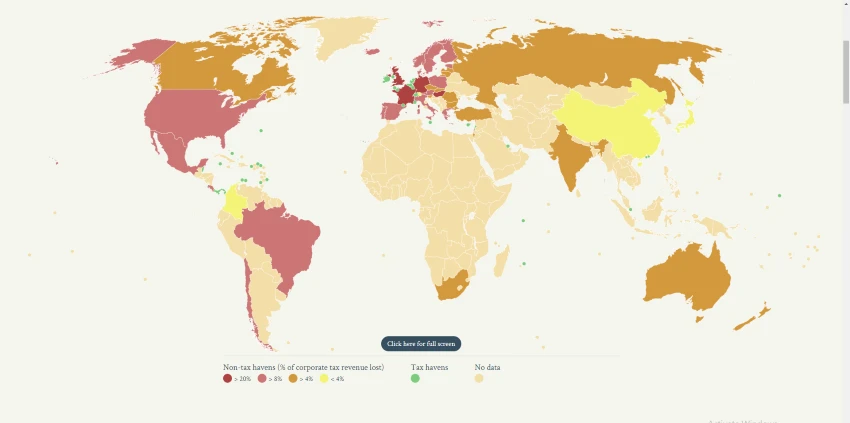

You can explore the map to see which countries attract and lose profits in this shell game. By clicking on each country you can see the amount of profits shifted to tax havens and to which havens the profits were shifted. You can also see the implied loss of corporate income tax revenue. Some countries are marked in green; these are tax havens. For the tax havens we report how much profits they attract from high-tax countries and what the effective corporate income tax rate is.

The loss of profit is the highest for the (non-haven) European Union countries. U.S. multinationals shift comparatively more profits (about 60% of their foreign profits) than multinationals from other countries (40% for the world on average). The shareholders of U.S. multinationals thus appear to be the main winners from global profit shifting. Moreover, the governments of tax havens derive sizable benefits from this phenomenon: by taxing the large amount of paper profits they attract at low rates (less than 5%), they are able to generate more tax revenue, as a fraction of their national income, than the United States and non-haven European countries that have much higher tax rates.

Until recently, this research would not have been possible, because firms usually do not publicly disclose the countries in which their profits are booked, and national accounts data did not make it possible to study multinational corporations separately from other firms. But in recent years, the statistical institutes of most of the world’s developed countries (including the key tax havens) have started releasing new macroeconomic data known as foreign affiliates statistics. These data allow to obtain a comprehensive view of where multinational companies book their profits, and in particular to estimate the amount of profit booked in tax havens globally. To further our understanding of this issue we need more and better data. In particular it would be desirable that all countries publish foreign affiliates statistics, and that these statistics be extended to always include information on taxes paid.