This scenario now seems to have peaked and may see a downward spiral in the next decade.

Impact of US-China trade war

As far as economic growth is concerned, Asia is the fastest growing region in the world. In terms of contribution towards global prosperity, Asia’s participation is more than substantial. Earlier, between 1952 to 1985, Japan was holding the strongest growth rate, when Japanese economy grew rapidly, especially between the period 1960 to 1973. However, in recent years, economic growth is not near Japan, but has shifted towards India, and more strongly towards China, which is the largest contributor to the global GDP from Asia.

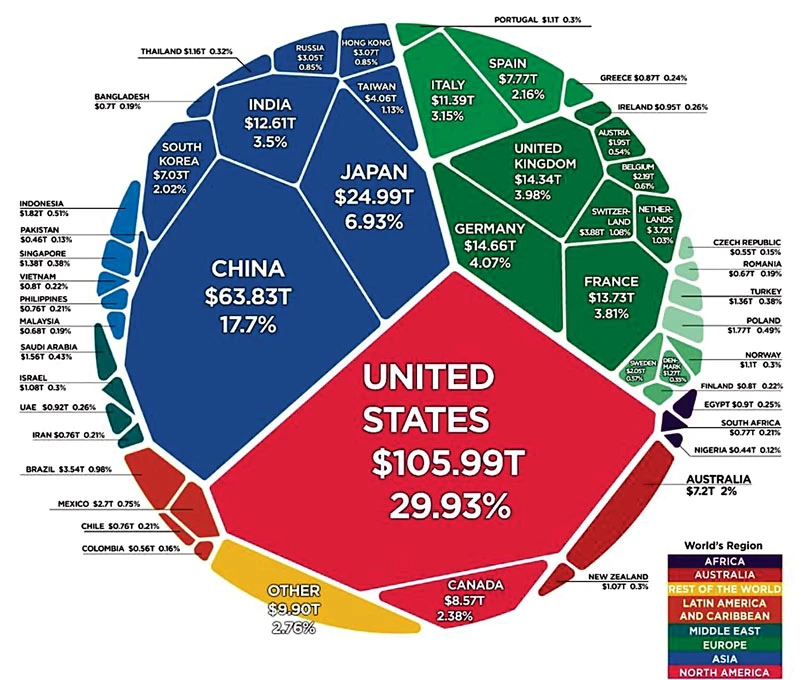

By 2020, about 84.3% of global economic contribution came primarily from 15 of the wealthiest countries. Comparing this contribution of 15 wealthy countries in the period just before the US-China trade war broke out, China’s contribution was also very large. However, now China has a much reduced growth momentum and is continuing to slump even further as the trade war escalates.

By the end of 2019, China's economy saw the slowest growth in the last 29 years at 6.1%, even though there was no sign of the Covid-19 pandemic at that time. The International Monetary Fund (IMF) forecasts that post Covid-19 pandemic, China will no longer be the strong growth engine for Asia as in the past. The heavy impact of the unending US-China trade war, the Covid-19 pandemic lockdowns, along with several setbacks in the process of rebuilding China's internal growth engine, will all create a worst case scenario for the Chinese economy.

The US-China trade war and the sudden outbreak of Covid-19, which has now become a serious pandemic, are two factors that have rattled China’s economy. Prior to the US-China trade war and the pandemic outbreak, China was trying to rebuild its economy in the direction of high growth and reduced dependency on investments. In the current scenario, domestic savings of the Chinese people is too high, hence making it difficult for demand to rise within the domestic market. Even though the Central Bank of China (PBoC) has reduced interest rate to stimulate consumption and reduce savings, people still are increasing their savings. This will not allow China to grow without relying on exports. The road to domestic growth is now clogged, and along with the on-going and unending US-China trade war, China's growth is in serious jeopardy. This surely places the concept of Asiaphoria at an unlikely spot of ever becoming a reality.

China's growth is clearly forecast to slow down, seriously impacted by the two consecutive and now simultaneous shocks of the US-China trade war and the outbreak of the Covid-19 pandemic. Export turnover plays an important role in the growth of any country, and China’s credibility is complicated in terms of semi-finished products, raw materials, and the issue of origin of goods. Now more than ever, US based companies, along with other big businesses in other countries like Japan and in Europe, must begin to reduce their dependency on China. This shift must be called for due to the current tariff war between US and China, and not because of doubt in China’s capabilities to deliver.

‘Chinese Dream’ an illusion

The ‘Chinese Dream’ and President Xi Jinping's ‘One Belt, One Road’ strategy were expected to be a glory on the economic front. These now may remain as dreams without ever becoming a reality. Asiaphoria, if it had happened, accompanied by China's power over other Asian countries, actually would not have brought much positive growth to the global economy, because growth would have been scattered and not evenly spread out.

China is deeply integrated in the global value chain, because of its status among the top ten exporting countries. Therefore, at some stage of production, semi-finished products that come from China are most certainly involved. The whole world has been quite inescapably dependent on China and its manufacturing ability, so much so that China's GDP growth was once a reference when people wanted to forecast global growth. This will no longer be the case in future, when semi-finished products will come from newer sources, and finished export goods will reach consumers via a different route altogether. Opportunities are opening for countries such as Vietnam and the Philippines for the manufacturing of semi-finished products or finished export products originating outside China.

Within the next few years, the sudden and urgent scramble to relocate production units from China to various other countries will bring a halt to China’s dream of maintaining the world’s manufacturing factory. China's job employment and new order of growth cannot be driven by the rebalancing of investment and domestic consumption, so it is absurd to assume that China can achieve success in the aftermath of the Covid-19 pandemic.

Therefore, to maintain a more balanced and realistic growth, all countries need to reduce dependency on China, and pivot towards other countries in Asia. This will create a positive growth in many countries that will receive new investment opportunities. Though these new growth opportunities will benefit several other countries in Asia, they will prove to be a serious loss for China. For China, both the US-China trade war and the Covid-19 pandemic has been like a death knell. It seems that this will be the beginning of the end of Asiaphoria in the next decade to come, and will pave the way for another new era of world economy.