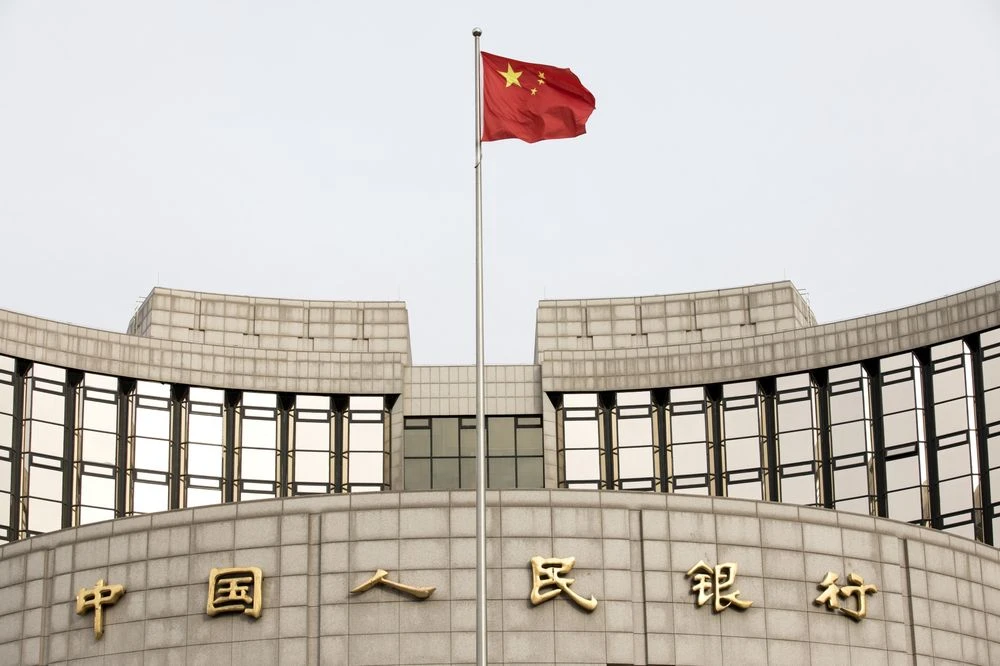

The People’s Bank of China reduced the interest rate on 7-day reverse repurchase agreements to 2.2% from 2.4% when it injected 50 billion yuan ($7.1 billion) into the banking system, according to a statement Monday. The central bank said this will keep liquidity sufficient to help the real economy.

The first cut to a PBOC policy rate since February is in line with a pledge by the Communist Party’s leadership on Friday to increase support to the economy through increased sales of sovereign debt, as domestic and international demand slumps due to the pandemic. The step brings the PBOC closer in line with the stance of global peers, who have loosened policy dramatically in recent weeks.

“The larger-than-usual rate cut is an expression that China is willing to join the coordinated consortium for economic stabilization,” said Raymond Yeung, chief China economist at Australia & New Zealand Banking Group in Hong Kong. “Small and medium-sized businesses are collapsing for lack of cash flow.”

Further Cuts Expected

A reduction in the central bank’s main tool to adjust the price of market liquidity also signals coming reductions in its main one-year funding tool, and potentially a corresponding cut to the benchmark deposit rate. Reductions to policy rates should also be reflected in the main market benchmark of the cost of lending to companies, the loan prime rate.

“Lowering banks’ lending rates without a reduction in the cost of their liabilities will squeeze banks’ net interest margin, eroding their profitability and capital base,” said Ding Shuang, chief Greater China and North Asia economist at Standard Chartered Bank Ltd. “A benchmark deposit rate cut is necessary.”

China will increase its fiscal deficit as a share of gross domestic product, issue special sovereign debt and allow local governments to sell more infrastructure bonds as part of a package to stabilize the economy, according to a Politburo meeting on Wednesday, Xinhua reported late Friday.

In a separate statement published late Friday, the People’s Bank of China called for better coordination of global macro policies, while re-emphasizing it will keep liquidity sufficient to help with the real economy and watch out for inflation risks.

Plenty of Room Left

The cut Monday signals the PBOC has entered “a stage with stronger counter-cyclical adjustment,” out of consideration of both domestic demand and the global virus outbreak, Ma Jun, a PBOC adviser, said in a statement sent to the media after the rate cut. “The PBOC doesn’t use its bullets all at once. China still has plenty of room in monetary policy.”

Economists have lowered their median forecast for economic growth to 2.9% for 2020, the slowest pace since 1976, when the Cultural Revolution wrecked the economy and society. Until the past few days, China’s policy makers had maintained a relatively cautious program of easing, mindful of the nation’s heavy debt load and of risks to financial stability.

While the Politburo statement and the PBOC move signal the response is moving up a gear, it still falls short of a no-holds-barred stimulus.

The leaders of the Group of 20 said last week they were injecting more than $5 trillion into their economies to fight the effects of the outbreak. Central banks globally have slashed interest rates and started quantitative easing programs.

“Certainly, the policy easing is continuous and today’s liquidity injection at least suggests that the policy aid will be mildly constant and will be more proactive when the authorities deem necessary,” said Zhou Hao, an economist at Commerzbank AG. “China is joining the global easing wave.”