Capitalization still low

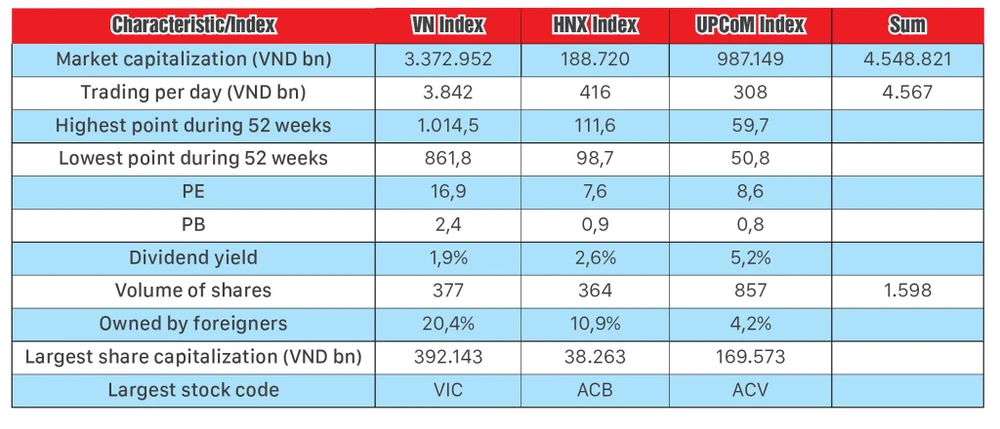

The Vietnam stock market has grown rapidly in recent years and is increasingly becoming linked more and more closely with the economy of the country. However, market capitalization is still much lower than in other countries in the region.

According to the State Securities Committee (SSC), market capitalization reached above 80% at the end of September 2019. Based on the assumption that economic growth is 6.8% and inflation around 4%, as per Government target for 2020, it is estimated that market capitalization needs to increase at least 35% in 2020 for it to reach 100% of GDP.

However, achieving a 35% growth in one year is unlikely. Looking back to the period from 2010 upto now, only in 2017 did the VN Index show an average increase of 48%. 2017 was also the year when capitalization of the stock market saw remarkable growth of more than 80% compared to the end of 2016, thank to a series of new listed enterprises such as VJC (Vietjet Air ), HVN (Vietnam Airlines), PLX (Petrolimex), VPB (VPBank) and VRE (Vincom Retail). It was also due to major divestments taking place such as VNM (Vinamilk) and SAB (Sabeco), with an increase of 66% and 26% compared to the end of 2016. The statistics showed that IPOs and divestments in some of these large businesses accounted for more than 50% of the total market capitalization increase in 2017.

Divestment and IPO prerequisites for growth

Vietnam's stock market is developing rapidly and becoming more and more closely linked with the economy, but the 2017 phenomenon will be difficult to repeat in the near future. In the context that the VN Index will find it difficult to achieve the 35% growth mark as mentioned earlier, divestment and IPO are prerequisites to achieving this milestone.

List of big enterprises expected for IPO and divesting in 2020 include Vietnam Engine and Agricultural Machinery Corporation (VEAM); Petrolimex; Vietnam Bank for Agriculture and Rural Development (Agribank); General Vietnam Chemicals Corporation (Vinachem); Power Generation Corporation 1 (Genco1); Power Generation Corporation 2 (Genco2); Mobifone Telecommunications Corporation (Mobifone);and Vietnam Cement Corporation (Vicem).

However, Vietnam's stock market is still supported by many other factors. Domestic factors such as GDP growth in nine months of 2019 was the highest in the past nine years and Vietnam is one of the countries with the most stable politics in the region. The growth rate of income per capita and unemployment are also moving in positive direction. In the near future, economic growth in 2020 will be supported by domestic consumption, foreign direct investment (FDI) and public investment.

In particular, public investment is expected to increase and disburse faster in 2020, when the revised Public Investment Law will be passed and come into effect early next year. In addition, a series of key projects such as the North-South expressway and Long Thanh international airport will be implemented.

Expectations of more foreign capital flow

Foreign capital inflow into Vietnam has grown by 7.5% in the past eight years, and is forecast to continue to grow because of free trade agreements (FTAs) that Vietnam has signed or is about to sign, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and FTA Vietnam-EU (EVFTA). In addition, with the advantage of cheap labor and the ongoing US-China trade tensions, Vietnam is also considered as an attractive future destination by foreign investors.

In developed markets, government bonds yield has increased since the end of August and early September. This is a sign that the cash flow is looking for a safe haven and Government bonds have softened. In other words, investor expectations about recession risks has started to decline. In addition, the possibility of the US Federal Reserve (Fed) continuing to lower interest rates from now until the end of the year is not high. Ten-year G-bond yields of the US can vary from 1.5 to 1.8%. At the same time, finding opportunities for stock investment in developed markets, typically the US, is no longer easy when the P/E level of the S&P 500 has reached a one year peak.

It is not yet confirmed that foreign investors will pour money into new markets, but Vietnam's stock market can be considered quite attractive when Vietnam is a rare economy that maintains a high growth rate. The biggest obstacle for foreign investors today is probably the issue of limited ownership, when businesses with good fundamentals are almost out of date. However, the rules for issuing new index baskets have been in place for more than two months, expecting more ETFs to be launched in the near future.

It can be said that divestment and equitization in 2020 will be hotter than ever, creating opportunities for foreign investors to hold leading stocks in important fields such as banking, oil and gas. In the long term, the market can expect the revised Securities Law to solve ownership issues of foreign investors.

However, the stock market still faces many risks from interest rates that continue to rise, especially long-term interest rates, and regulations on divestments are still confronted with many obstacles and risks that the world market cannot control, such as the current unstoppable trade war between the US and China. Besides these factors, geopolitical risks can also affect oil prices.