Entry of new investors

As the Covid-19 pandemic spread across countries, thousands of people lost their lives and the global economy began to steadily fall into a recession, with millions of businesses going bankrupt and asking for bailouts, while thousands and thousands of workers in all countries were laid off. In all this phase, the stock market showed excitement during the boom period of the bull market, which culminated in the entry of a series of unprofessional investors who had never traded in stocks before, and who even arrogantly bragged of their profits, or smirked at the cautious approach of professional investors.

Dave Portnoy, who owns Barstool Sport and also runs a sports blog, started participating in the stock market when the US government implemented social distancing to combat the Covid-19 pandemic. Dave Portnoy had previously bought only one single stock, but what made this new investor famous was the livestreaming of all his trading activities at very high profits. More than 1.5 million people followed his live videos. This seemed like a mockery to legends such as Warren Buffett, but new investors like Dave Portnoy are right. Investment bank Goldman Sachs found that this popular portfolio was 61% profitable compared to a 45% increase in the portfolio held by other professional investment funds.

In the Vietnamese market, it is not difficult to find many such successful cases in the last two months. Stock forums are also full of braggarts, and any risk warnings are being mocked at. The new investors, called the F0 generation, are trying to prove their superiority by showing profits in tens of percentage points higher than average. For professional investors, this is a typical sign of an optimistic boom trend. However, complacency is rampant in a majority of new investors who now find it easy to make money on the stock market, often appearing at peak of bull markets.

Bleak results for second quarter

Noticeably, in the first two weeks of June, this momentum in markets slowed down. Fears and expectations of a resurgence of the disease could have been the reason. Several US states recorded an increase in the number of infected people after partial opening of the lockdown measures and fears of the disease recurring has hindered economic recovery since the first week of June.

On 10 June the VN Index reached its highest peak at 900 points, but then corrected to drop by 45 points on 17 June. The pandemic is basically under control within Vietnam borders and there are no new infections being reported. The main economic indicators such as import and export, industrial production, and retail sales in May showed positive improvements. However, achieving the same levels as before seems impossible, and that is why many businesses have not set goals because there are too many uncertain factors impacting the future.

A small but important segment of listed companies is the banking group are expected to significantly reduce profits for the second quarter. Eximbank expects its second quarter profit to be only half of the first quarter. However, EIB share price is currently at its highest level since the beginning of the year. EIB even reduced its profit target by 40% for the whole of 2020. Most large and small banks held a shareholders meeting to adjust their profit reduction. Many other businesses also proposed to shareholders to reduce their profits, such as MWG to go down 28.6%, PNJ expected to show at 30%, and HBC down to 31%. A General Report by Fiingroup in early June suggested that the Covid-19 pandemic would reduce the profitability of listed non-financial businesses in 2020 by about 12%, compared to 2019.

Statistics of first quarter business results of nearly 1,000 businesses show that revenue decreased by 4.4% over the same period, and profit after tax plummeted nearly 58%. The analysis report of securities companies is also pessimistic, saying that the market is moving a bit faster than basic valuation. Rong Viet Securities Company stated that the second quarter will record the worst business results in many fields, as well as GDP growth. This makes the market appear to be more volatile compared to the beginning of the year, when the VN Index fell only 8.5% and in the forecast basic profit per share adjusted to a negative 4% instead of 12%, as it was at the beginning of the year.

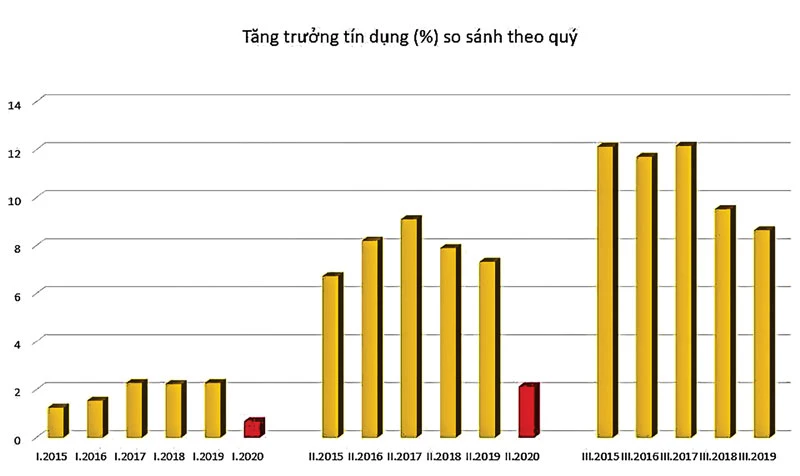

An important forecast indicator of business activities to come in the second quarter, or the rest of the year 2020, shows many difficulties, with slow credit growth rate in the first quarter to 0.68%, only reaching 2.13% in mid-June. In the interbank market, overnight interest rates from 19 May began to fall below 1%, and from 16 June at a record low of 0.17%. Interbank interest rates for a one-month term also dropped to below 1% for the first time, currently at 0.74%. This situation shows excess of liquidity in the banking system, behind which enterprises cannot absorb capital because there is no demand from production and business activities, or there is an inability to meet loan conditions.